Cleaning Services Near Me in Chester

House Cleaner in Chester

Chester Cleaner

I offer house cleaning services in Chester and surrounding areas. Bathroom cleans, regular house cleans including a weekly service or my most popular fortnightly house clean.

My bathroom and kitchen cleans will leave your home sparkling, many people have said that I am the best cleaning service in Chester and they love it when I have been and they arrive home from work to a lovely clean home. Tables and sideboards polished as part of a regular housekeeping routing.

I am an insured and DBS checked self employed cleaner keeping my cleaning prices low as possible.

If you are looking for a domestic cleaner in the Chester area then please contact me.

Phone: 07710 689823

Email: [email protected]

Chester

‘Sophie provides the best cleaning service in Chester’

‘Miss Sparkles lives up to her name with the best house clean we have ever had’

‘Amazing house clean, smells beautiful after a bathroom clean from Sophie’

Housework and Cleaning, Cleaner Chester

Kitchens, bathrooms, toilet, en-suite, front room, bedrooms and practically any other room in your home will get the Fairy Sparkles treatment when you book me for cleaning. I polish and clean getting rid of dust and dirt thus leaving your surfaces sparkling and clean. Are you are looking for a house cleaner in Chester?

I love to clean, let me do your cleaning whilst you do something else.

Chester

Am I the best house cleaner in Chester? Many of my customers think so.

Contact Fairy Sparkles – One of the Best Cleaners in Chester

If you are looking for a one off house clean, a weekly clean or a fortnightly clean please get in touch. I am self-employed and happy to discuss options for cleaning your home.

Send Message

Please let me know if you have specific cleaning requirements

How do I clean?

List of the main cleaning services I offer, if I haven’t covered something you are interested in please contact me. As a local cleaner I love to clean houses and leave your home sparkling.

Kitchen Clean Chester

A deep clean of the worktop surfaces, tops and faces of cupboards, hob, sink and drainer, windows, the floor and skirting boards.

Anti-bacterial products will be used in order to keep away the germs!

Bathroom, En-suite & Toilet Clean Chester

A standard family size – including a sink, toilet, En-suite, bath or shower.

A deep and fresh clean of everything in sight!

Anti-bacterial and bleach products will be used to keep the germs away!

Full House Clean Chester

A deep clean to everything in sight – windows, tops and faces of cupboards and drawers, and the floor and skirting boards.

Hoovering and mopping and dusting of your entire house, to regain the sparkle!

Regular House Cleans Chester

I can do weekly, fortnightly or monthly cleans. A regular cleaning service is the best option for keeping your home fresh and sparkly.

Other Rooms Cleaned

Maybe you just want an odd room cleaned, study, living room, bedroom, conservatory, dining room etc.

Cleaning for Special Occasions

Are you looking to have a spring clean ready for a party? Maybe you are looking to leave a rented house or apartment and want it left sparkling?

Chester’s leading eco-friendly cleaning services, where sparkling homes meet environmental care. As a dedicated local cleaner, insured and DBS-checked I am passionate about bringing the gleam back to your home with my comprehensive cleaning solutions. From meticulous bathroom cleans to regular housekeeping routines, I ensure every corner of your home shines. Discover the difference with my popular fortnightly or weekly cleaning plans and experience why many consider me the best cleaning service in Chester.

Chester Cleaning

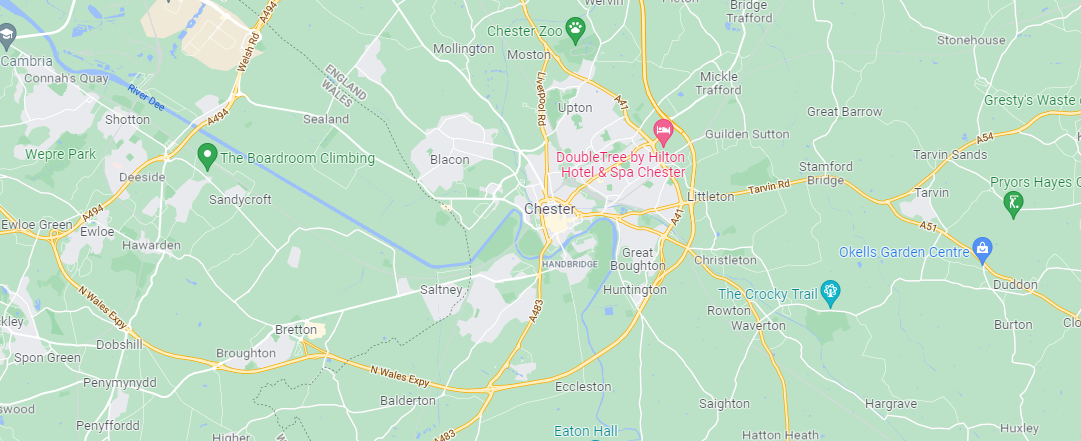

What other areas in and around Chester and Cheshire do I offer cleaning services?

- Cleaning Services Near Me in Bangor-on-Dee

- Cleaning Services Near Me in Borras

- Cleaning Services Near Me in Buckley

- Cleaning Services Near Me in Caerwys

- Cleaning Services Near Me in Cheshire

- Cleaning Services Near Me in Chester

- Cleaning Services Near Me in Christleton

- Cleaning Services Near Me in Deeside

- Cleaning Services Near Me in Elton

- Cleaning Services Near Me in Ewloe

- Cleaning Services Near Me in Frodsham

- Cleaning Services Near Me in Gresford

- Cleaning Services Near Me in Halkyn

- Cleaning Services Near Me in Hawarden

- Cleaning Services Near Me in Helsby

- Cleaning Services Near Me in Higher Kinnerton

- Cleaning Services Near Me in Hooton

- Cleaning Services Near Me in Kingsley

- Cleaning Services Near Me in Manley

- Cleaning Services Near Me in Marchwiel

- Cleaning Services Near Me in Mollington

- Cleaning Services Near Me in Mouldsworth

- Cleaning Services Near Me in Mynydd Isa

- Cleaning Services Near Me in Nannerch

- Cleaning Services Near Me in New Brighton

- Cleaning Services Near Me in Northop

- Cleaning Services Near Me in Overton

- Cleaning Services Near Me in Penley

- Cleaning Services Near Me in Penyffordd

- Cleaning Services Near Me in Preston Brook

- Cleaning Services Near Me in Rhosddu

- Cleaning Services Near Me in Rhosnesni

- Cleaning Services Near Me in Rossett

- Cleaning Services Near Me in Ruabon

- Cleaning Services Near Me in Runcorn

- Cleaning Services Near Me in Saltney

- Cleaning Services Near Me in Stretton

- Cleaning Services Near Me in Sutton Weaver

- Cleaning Services Near Me in Warrington

- Cleaning Services Near Me in Waverton

- Cleaning Services Near Me in Widnes

- Cleaning Services Near Me in Wrexham

- Cleaning Services Near Me on the Wirral

If you live in the following areas in Chester and want a house clean or an apartment clean please get in touch.

- Sealand

- Blacon

- Upton

- Newton

- Saltney

- Handbridge

- Curzon Park

- Westminster Park

- Hoole

- Saughall

- Mickle Trafford

- Guilden

- Sutton

- Great Barrow

- Littleton

- Christleton

- Rowton

- Waverton

- Saighton

- Backford

- Mollington

- Hatton Heath

- Eccleston

- Huntington

- Great Boughton

- Hawarden

- Dodleston

- Higher Kinnerton

- Bretton

- Broughton

- Pulford

- Tattenhall

- Rossett

Why Choose My Chester Cleaning Services?

Unmatched Quality and Reliability

- Attention to detail for every clean

- Regular, fortnightly, and weekly cleaning options

- Affordable cleaning service

My Cleaning Services in Chester

Comprehensive House Cleaning

Kitchen and Bathroom Deep Cleans

Regular Housekeeping

Specialised Cleaning Services

Spring Cleaning Extravaganzas

What Sets Me Apart?

Professional and Insured Cleaner

- Peace of mind and DBS checked

Flexible Scheduling

- Tailored to fit your busy lifestyle